Short selling—a term that often bewilders new traders, conjuring questions of how one can sell something they don’t possess. A practice rooted in the stock market, long before forex entered the scene, it’s a fascinating mechanism that defies convention and opens doors to unique trading strategies.

Originating as a tool for speculating on plummeting stock prices, short selling has evolved into an intricate dance between traders, brokers, and market dynamics. In the realm of forex, where currencies collide and fortunes are forged, short selling takes on a distinct form—one that demands understanding and precision.

Decoding the Short Selling Puzzle

The genesis of short selling traces back to stock markets, where traders anticipated price descents and sought ways to capitalize. But how can one sell an asset they lack? The answer rests in a symbiotic relationship—the trader aiming to bet against a stock often doesn’t hold it, yet another trader does.

Brokers sensed an opportunity in this intricate dance. Enter the broker, orchestrating a symphony by aligning stock holders with traders yearning to sell without ownership. This ingenious maneuver led to a harmonious exchange, enabling trades that seemingly defied logic.

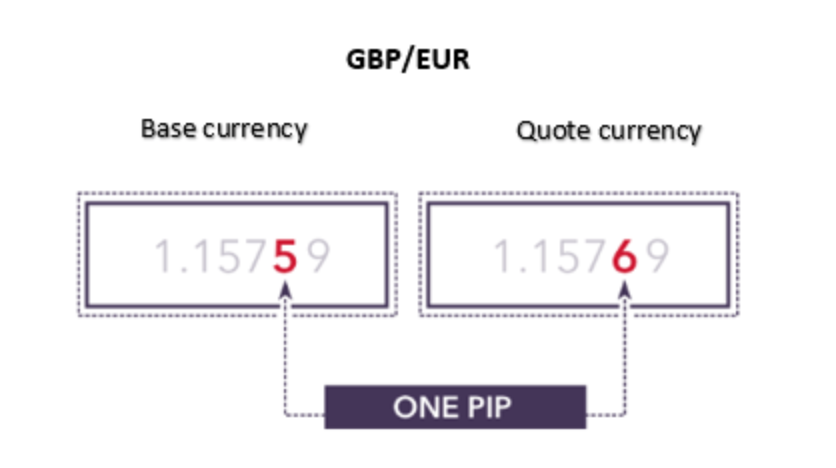

In the forex universe, a different tapestry unfurls. Unlike stocks, currencies unfold a unique transactional choreography. Imagine a currency pair—a duo entwined in a financial waltz. Picture the GBP/EUR, a pair where the base currency and the quote currency dance in tandem, each step embodying the ebb and flow of exchange rates.

The Enigma of Short Selling: Unveiling the Dance

Embarking on a short position within the forex domain ventures beyond the mundane. Here, understanding currency pairs, embracing system functionality, and embracing risk management rules the stage.

When you decide to short sell a currency pair, a unique symphony unfolds. You’re essentially vending the base currency, all the while acquiring the quote currency, poised for an impending drop in the currency pair’s value. Unlike stocks, this process doesn’t entail “borrowing” assets, simplifying the choreography of short selling.

Let’s demystify the process with an example: the revered EUR/USD currency pair. Picture yourself poised to sell the EUR/USD, a transaction that involves not just selling euros but buying dollars as well. This elegant dance occurs without the complexities of borrowing, as quotes seamlessly facilitate short selling.

Clicking “Sell” on the quote paves the way for the EUR/USD short sell. To exit the trade, a simple “Buy” beckons—a profitable endeavor if the purchase price is lower than the sale price, disregarding fees and commissions. A partial closure option adds an artistic flourish, enabling partial exits from the stage.

Imagine initiating a $100,000 short position on EUR/USD at 1.29. As the curtains rise, envision the price descending—a spectacle that could yield profits, minus the nuances of commissions. Now, let’s say our trader predicts further declines but opts for a partial exit, symbolizing finesse amidst the art of trading.

Manually inputting “0.5” and tapping “Close” commences a graceful exit, offsetting half of the initial $100,000 short position. As the curtains lower on this segment, profits crystallize—a harmonious fusion of strategy and execution.

Risk Management: Navigating Choppy Waters

The realm of short selling brims with allure, yet harbors lurking risks. Unlike long trades, where losses have an eventual floor, short selling’s risks stretch into infinity. With no defined cap, forex values can spiral without constraint.

Mitigating this peril demands a strategic approach:

- Implement Stop Losses: Erect protective barriers against losses, ensuring a safety net shields your capital.

- Navigate Support and Resistance: Monitor these key thresholds for entry and exit signals, harnessing strategic decision points.

- Stay Informed: Tune into economic news and events, fortifying your readiness for potential downturns.

- Leverage Price Alerts: Amplify vigilance with mobile/email notifications, alerting you to price milestones even when away from the trading platform.

Short selling bears its heftiest fruit within downtrending markets. However, the risk-reward calculus calls for meticulous calibration. A favorite tool of institutional hedges and traders navigating descending markets, risk management’s sanctity is paramount. This primer, a stepping stone, should be embraced with unwavering caution as the terrain holds unpredictable twists.

Further Exploration: Your Ongoing Journey

As the final curtain falls on this exploration, your odyssey in short selling’s realm begins. With Trendfxnow.com as your guiding beacon, equip yourself with insights and tools to master the art of short selling. Remember, the fusion of strategy and risk management paints a masterpiece in the realm of forex. With each trade, you script a new chapter, navigating the enigmatic seas of short selling with elegance and precision.

Comments by Trendfxnow